Cass Information Systems (CASS): Margin Decline Raises Fresh Questions on Quality Growth Narrative

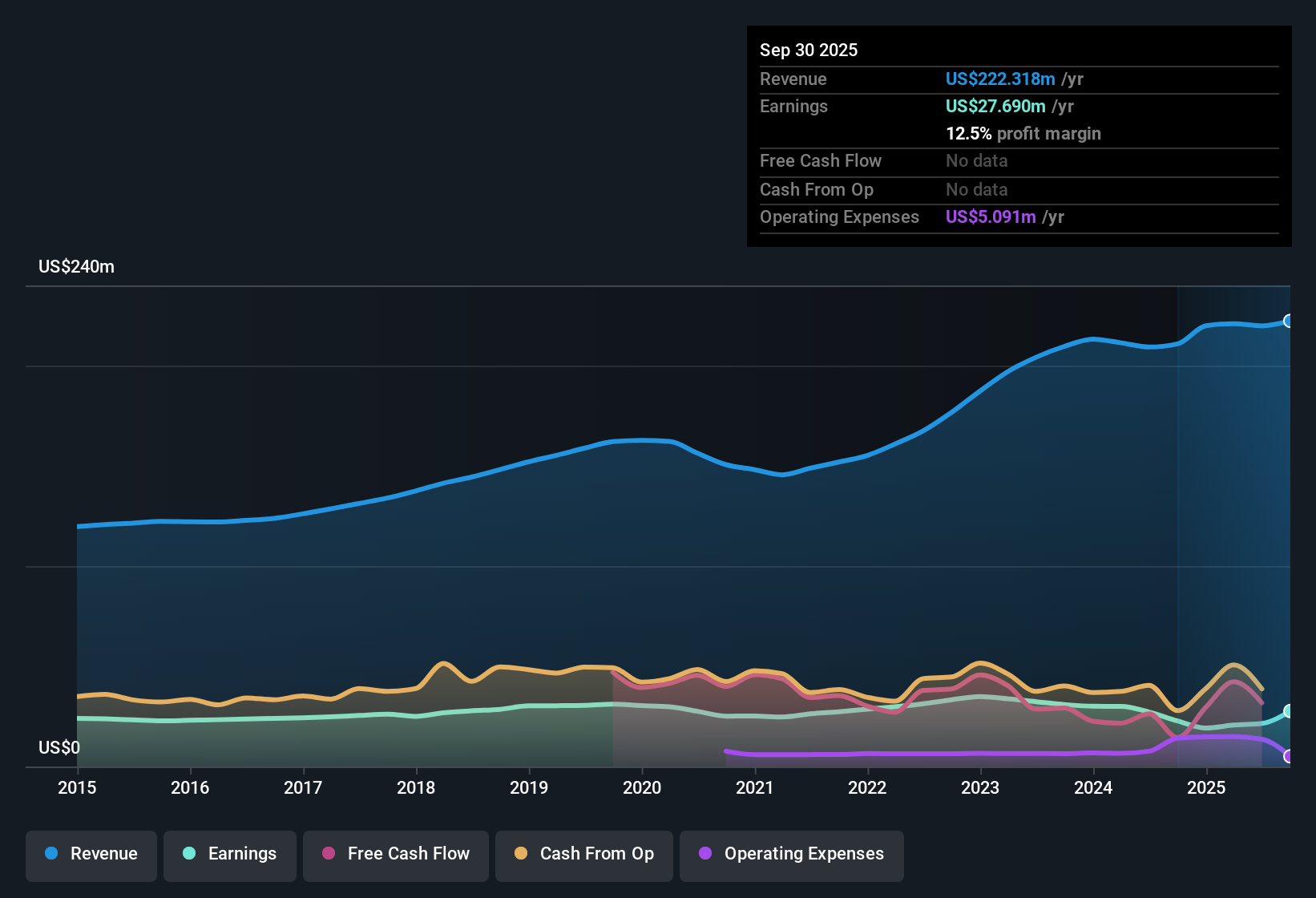

Cass Information Systems (CASS) posted a net profit margin of 9.8% for the latest period, down from 13% in the previous year. The company’s revenue is projected to grow at 5.7% annually, which trails the broader US market growth rate of 10%. Over the last five years, earnings have declined at an average pace of 2.9% per year, and the current price-to-earnings ratio stands at 24.2x, exceeding both its peer average and industry benchmarks. The story for investors centers on slower growth and shrinking margins, even as the dividend offers some compensation for weaker earnings dynamics.

See our full analysis for Cass Information Systems.

Next up, we’ll dig into how these results measure up against the prevailing narratives in the market. Some themes may be reinforced, while others face new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Earnings Premium Signals Rich Valuation

- The company’s P/E ratio stands at 24.2x, noticeably higher than its peer average of 23.7x and the broader US Diversified Financial industry’s average of 16.2x. This highlights that the market is willing to pay a higher price for each dollar of CASS’s earnings.

- Prevailing market analysis points to this valuation premium as a reflection of investor faith in Cass Information Systems’ steady, recurring revenue and perceived quality, but that support hinges on continued business stability.

- While investors might tolerate the premium if growth or margins rebound, slower topline gains of just 5.7% annually leave Cass exposed if sector sentiment shifts in favor of faster-growing peers.

- What stands out is that with the current share price at $39.43, CASS also trades slightly above its DCF fair value of $39.23, adding an extra layer of caution for value-focused investors watching for clear turnaround signals.

Profit Margins Squeezed Amid Sector Pressures

- Net profit margin has slipped from 13% to 9.8% year-on-year, a decline not matched by any improvement elsewhere in the EDGAR filing’s summary of performance metrics outside of stable dividend payout.

- The current investment perspective highlights how the company’s dependable, incremental improvements can only partially offset concerns that earnings quality is under threat from margin compression.

- Continued downward pressure on margins, with no offsetting innovative wins or cost reduction headlines, raises the risk that CASS will be viewed as a steady but unexciting player in a sector that increasingly rewards disruptive growth.

- Despite those headwinds, Cass’s profile as a reliable payment processor, favored in less certain market periods, could still draw conservative investors, but not those seeking outperformance in the next upturn.

Dividend Remains the Key Offset to Growth Pains

- Despite shrinking margins and subpar revenue growth forecasts versus peers, the company’s dividend is described as “attractive” and forms a central pillar of the shareholder return case in the EDGAR summary.

- Many investors are weighing the dividend’s ability to compensate for tepid earnings and sideways growth trends, viewing it as the primary reason to hold shares even as headline financial metrics lose steam.

- With earnings declining at an average of 2.9% annually for five years, the argument for retaining the stock leans heavily on reliable dividend income rather than upside from business expansion.

- The market’s willingness to accept these trade-offs underscores a shift in sentiment. Cass is seen as a dependable income pick, not a dynamic growth story.

Next Steps

Don’t just look at this quarter; the real story is in the long-term trend. We’ve done an in-depth analysis on Cass Information Systems’s growth and its valuation to see if today’s price is a bargain. Add the company to your watchlist or portfolio now so you don’t miss the next big move.

See What Else Is Out There

With Cass Information Systems facing slipping profit margins, subdued revenue growth, and an above-average valuation, investors are left with limited upside and rising caution.

If you’re searching for opportunities with more compelling value and lower risk of overpaying, compare your options through these 876 undervalued stocks based on cash flows to target stocks whose prices reflect stronger fundamentals and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link