Customer Information System Market Size to Hit USD 5.23 Billion by 2034

What is the Customer Information System (CIS) Market Size?

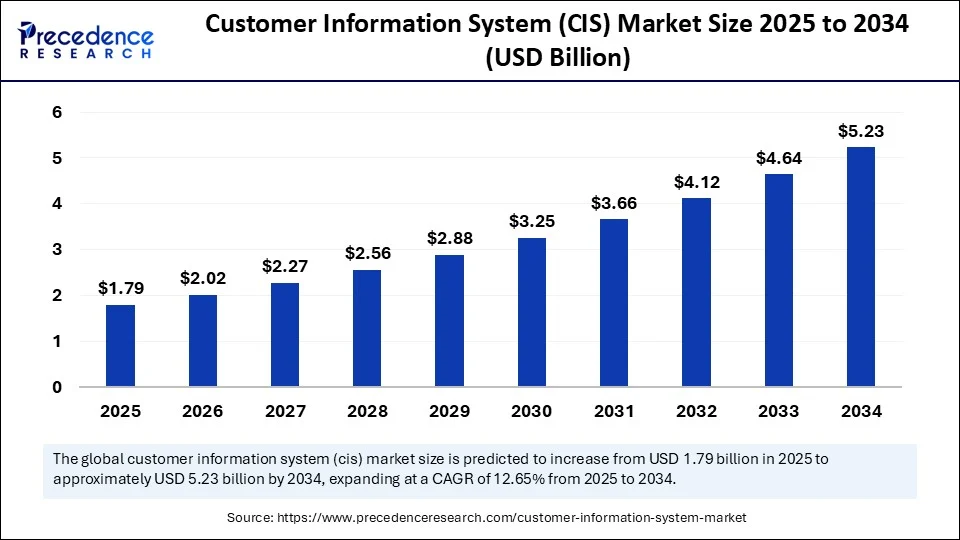

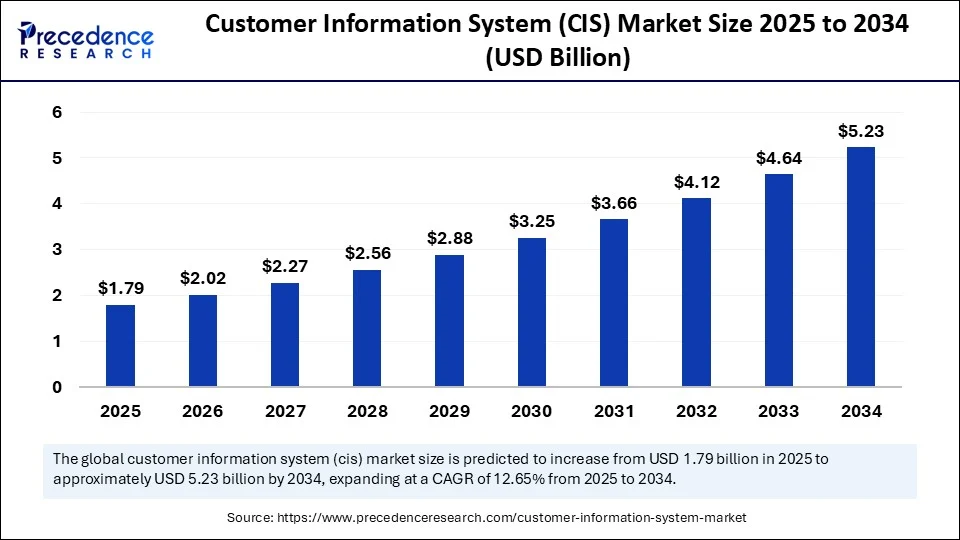

The global customer information system (CIS) market size is valued at USD 1.79 billion in 2025 and is predicted to increase from USD 2.02 billion in 2026 to approximately USD 5.23 billion by 2034, expanding at a CAGR of 12.65% from 2025 to 2034. The market growth is attributed to the rising demand for integrated platforms that enable real-time billing, secure customer data management, and personalized service delivery across digital channels.

Customer Information System (CIS) MarketKey Takeaways

- The global customer information system (CIS) market was valued at USD 1.59 billion in 2024.

- It is projected to reach USD 5.23 billion by 2034.

- The market is expected to grow at a CAGR of 12.65% from 2025 to 2034.

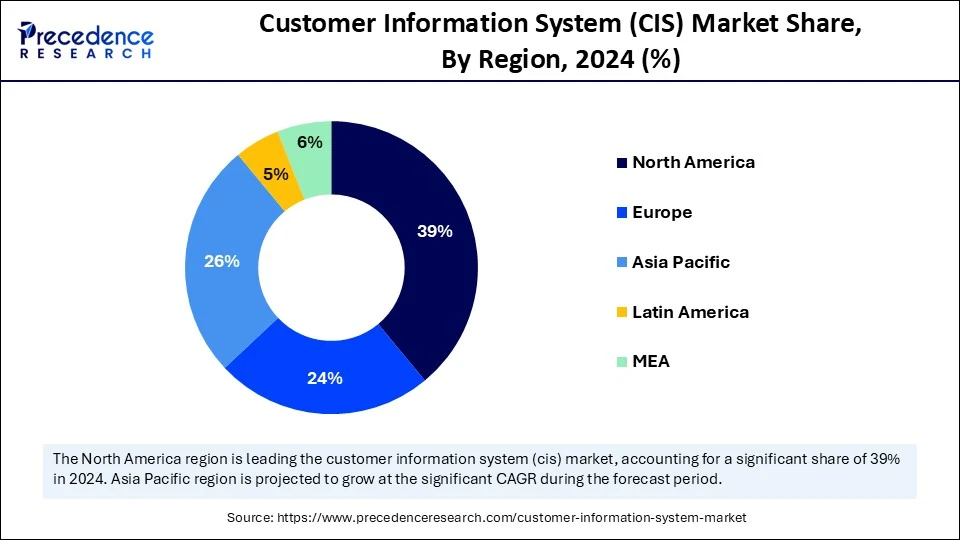

- North America dominated the global customer information system (CIS) market with the largest share of 39% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 15.35% from 2025 to 2034.

- By component, the solutions segment held the major market share of 66% in 2024.

- By component, the services segment is expected to grow at the highest CAGR during the forecast period.

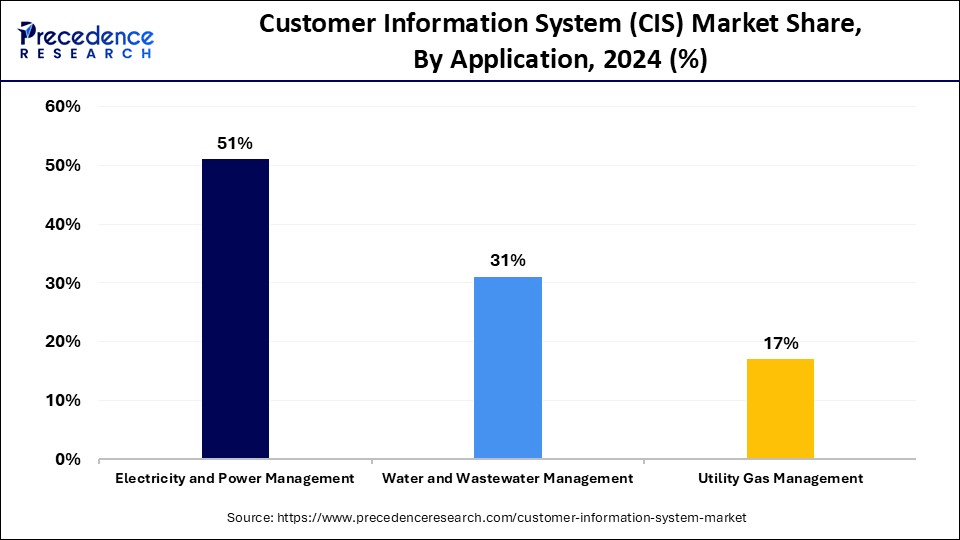

- By application, the electricity and power management segment contributed the biggest market share of 51% in 2024.

- By application, the utility gas management segment is expected to expand at a significant CAGR between 2025 and 2034.

Artificial Intelligence: The Next Growth Catalyst in Customer Information System (CIS)

Artificial intelligence (AI) is redefining customer information systems, enabling organizations to manage and use data more intelligently and responsively. Industries like utilities, telecom, and finance are integrating AI into their information systems to automate repetitive tasks, find anomalies, and create personalized experiences based on real-time insights. AI-driven systems continuously learn from user behavior and anticipate service requests. Furthermore, AI helps companies divide their user base into specific categories with better precision, predict the demand more precisely, and automate billing or customer service.

Strategic Overview of the Global Customer Information System (CIS) Industry

The growing digitalization of the utility and finance industries is driving the demand for customer information systems (CIS). As companies actively seek to enhance customer engagement, billing, and data management, CIS platforms are emerging as a unified solution. These systems collect customer data, handle billing and payments, and facilitate multi-channel communication. The U.S. Department of Energy’s smart grid initiatives create the need for an interoperable CIS platform to achieve its goals outlined in Grid Modernization Initiative 2024. CIS platforms are also the key aspects of interfacing with Internet of Things (IoT) devices and incorporating AI-driven analytics that could be used to deliver predictable services. Furthermore, the market is expected to expand due to the rising deployment of utility-scale smart meters and real-time data analytics.

Customer Information System (CIS) MarketGrowth Factors

- Growing Emphasis on ESG Reporting Requirements: Rising environmental, social, and governance (ESG) mandates are driving enterprises to adopt CIS platforms that support transparent utility consumption and customer interaction tracking.

- Boosting Digital Payment Ecosystem Integration: The rapid expansion of mobile and digital payment systems is fueling demand for CIS solutions that can manage real-time billing and secure transaction records.

- Driving Transition to Cloud-Native Architecture: Increasing preference for cloud-first strategies is accelerating the migration of CIS platforms to scalable, secure, and cost-efficient cloud environments.

- Rising Demand for Personalized Customer Engagement: Utilities and service providers are boosting investments in CIS to support AI-driven personalization and dynamic customer communication strategies.

- Fueling Smart Meter Data Synchronization Needs: Deployment of smart meters across utilities is driving the need for CIS platforms capable of integrating and analyzing granular, real-time usage data.

- Propelling Cross-Platform Customer Experience Management: Multichannel service delivery requirements are encouraging organizations to upgrade to CIS platforms that support seamless experience across web, mobile, and voice interfaces.

- Accelerating Compliance with Consumer Data Sovereignty Laws: Enforcement of region-specific data residency and privacy regulations is growing the demand for customizable CIS architectures aligned with local legal standards.

Market Outlook

- Market Growth Overview: The customer information system (CIS) market is expected to grow significantly between 2025 and 2034, driven by the enhanced customer engagement, adoption of smart grids and advanced metering infrastructure generates massive volumes of data, and digital transformation.

- Sustainability Trends: Sustainability trends involve cloud-based solutions and efficiency, integration with IoT and smart grid data, and sustainable CRM and customer engagement.

- Major Investors: Major investors in the market include Oracle Corporation, SAP SE, IBM Corporation, Hansen Technologies, Gentrack, and Itineris.

- Startup Economy: The startup economy is focused on niche pain points, cloud native and SaaS models, and AI and automation integration.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.23 Billion |

| Market Size in 2025 | USD 1.79 Billion |

| Market Size in 2026 | USD 2.02 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Real-Time Customer Data Access

The increasing demand for real-time customer data access is expected to drive the growth of the customer information system (CIS) market. Instant access to the latest customer profile is no longer a requirement but a necessity of utilities, telecom operators, and financial service providers. Utilization of CIS supports dynamic billing, outage management, and personalization of services. Customer information systems easily integrate with online shopping, smart devices, and the Internet of Things. These systems allow field workers and call representatives to make informed decisions without any latency.

Such responsiveness, by increasing the use of data, raises customer satisfaction, minimizes the time of complaint resolutions, and improves the quality of the services. Companies that invest in smart grids and digital financial platforms are still focused on real-time data access as one of the primary features. There was also an update of the same guidelines by the Federal Energy Regulatory Commission (FERC) in the year 2024, pushing electric utilities to adopt real-time data exchange models to improve their response to outages and communications to their customers. Furthermore, a new set of interoperability requirements that help to integrate customer data systems with distributed energy resources is expected to fuel the market.

(Source: https://www.energy.gov)

(Source:

Restraint

Data Privacy and Cybersecurity Concerns

Concerns over data privacy and cyber security are expected to hamper the growth of the customer information system (CIS) market. Customer information systems deal with sensitive consumer and organization data. This makes them vulnerable to data breaches. Rising cases of hacking and data theft lead many to question the security of such systems particularly in areas like finance and medicine. Furthermore, stringent regulations regarding data security and privacy create challenges in the market and limit innovations.

Opportunity

How Does Surging Investments in Smart Infrastructure Create New Opportunities in the Market?

Surging investments in smart infrastructure are projected to create immense opportunities for key players competing in the customer information system (CIS) market. Energy utilities and cities are implementing smart grids, automated metering infrastructure (AMI), and demand-side management systems, which often require robust back-end systems to handle customer interactions. Customer information systems help in secure integration with these systems, enabling real-time billing, outage notifications, and usage analytics.

As smart infrastructure projects are gaining momentum, specifically in developing economies and in metropolitan areas, the need for intelligent data systems increases. In 2024, the U.S. Department of Energy Department (DOE) expanded its Grid Modernization Lab Consortium to concentrate on the optimization of customer interaction platforms. Such initiatives further facilitate utilizing distributed energy resources and integration with electric vehicles and time-of-use revenues. Furthermore, the existence of a government-supported initiative project supports the importance of secure and inter-operable systems of customer information is boosting the market in the coming years.

Component Insights

Why Did the Solutions Segment Dominate the Market in 2024?

The solutions segment dominated the customer information system (CIS) market with the largest share in 2024. This is mainly due to the increased demand for modern customer engagement services and intelligent billing services. Organizations in the energy, telecom, and banking industries rely heavily on flexible, scalable, and secure software applications that provide real-time analytics, customer self-service capabilities, and seamless API. Such platforms facilitate omni-channel communication, forecasting of consumption and automated compliance reporting.

In 2024, the National Institute of Standards and Technology (NIST) and Federal Energy Regulatory Commission (FERC) encouraged utility providers to spend on modular software designs to support interoperability and security requirements. In 2024, the United States Securities and Exchange Commission (SEC) also issued revised guidelines. This guidance encourages more automation and openness in the management of customer financial information using digital systems that are compliant. Furthermore, such policy measures have been placed to strengthen the desire of the industry to have robust, modular software solutions that enable them to go online and have long-term capacity.

The services segment is expected to grow at the fastest rate during the forecast period, owing to the increasing demand for support services. As the adoption of CIS solutions increases, so does the need for installation, maintenance, and training and services in the utilities and financial institutions. Third-party services are critical to companies in order to customize solutions, facilitate large scale data migration, and ensure compliance with changing regulatory frameworks.

Numerous utilities in the process of smart grid modernization showed interest in managed services to match legacy infrastructure with digital platforms particularly in North America and Europe. Companies were also focused on service contracts so as to have minimal downtime, protection of sensitive information and even streamlining of system upgrades. Furthermore, the modern energy data ecosystem further confirms that the requirement of technical consultant services, thus further fuelling the segment.

Application Insights

How Does the Electricity and Power Management Segment Dominate the Market in 2024?

The electricity and power management segment dominated the customer information system (CIS) market with a major revenue share in 2024. This is mainly due to the increased consumption of electricity and the mass implementation of smart meters. Power utilities are increasingly implementing customer information systems to handle complicated billing mechanisms and monitor real-time consumption. In 2023, utilities in the U.S. and Europe increased their digitalization efforts in line with directives in policy to support clean energy transitions and customer-focused forms of service delivery.

These industries are investing heavily in digital customer information platforms, enhancing visibility into consumption models and outage communications. CISs enable providers in the electricity sector to provide custom alerts, dynamic pricing choices, and energy efficiency insights, hence increasing flexibility of operation and customer interaction. Additionally, the increased need to manage energy consumption and improve grid stability while meeting consumers’ needs boosted the adoption of CIS, bolstering segmental growth.

The utility gas management segment is expected to grow at the highest CAGR in the coming years, owing to the increasing focus on safety, accurate billing, and energy conservation. The use of customer information systems by gas utilities is increasing real-time monitoring and automated data analysis. In 2024, a large number of North American gas utilities started moving to digital platforms that are in line with federal standards from the Pipeline and Hazardous Materials Safety Administration (PHMSA) and the National Institute of Standards and Technology (NIST).

Such systems increase customer transparency through detailed usage reporting and warning of unusual use like leaks or excessive usage. Similarly, the European Commission’s smart energy roadmap emphasized digital customer management in gas distribution, promoting decarbonization and energy saving. Moreover, the rising demand for transparent billing practices and enhanced customer engagement information solutions is expected to drive the adoption of CISs.

Regional Insights

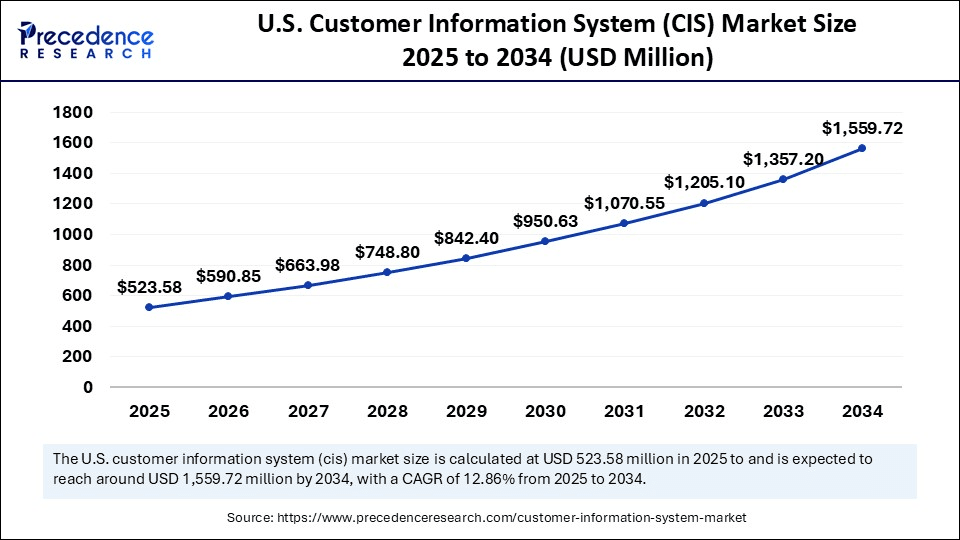

U.S. Customer Information System (CIS) Market Size and Growth 2025 to 2034

The U.S. customer information system (CIS) market size is exhibited at USD 523.58 million in 2025 and is projected to be worth around USD 1,559.72 million by 2034, growing at a CAGR of 12.86% from 2025 to 2034.

What Made North America the Dominant Region in the Customer Information System (CIS) Market in 2024?

North America dominated the customer information system (CIS) market, capturing the largest revenue share in 2024. This is mainly due to its robust regulatory environments, extensive roadmap of smart grid implementation, and high rate of digitization. Recently, utilities in the U.S. and Canada have introduced high-quality CIS solutions. This further achieves greater customer satisfaction and accurate billing and ensures adherence to federal policies on energy efficiency and data transparency.

U.S. Customer Information System (CIS) Trends

In 2024, the U.S. Department of Energy (DOE) invested heavily in the installation of smart grids under the Grid Deployment Office Program, creating the need for strong data management systems to communicate with consumers. Federal Energy Regulatory Commission (FERC) encouraged the real-time exchange of data between customers and utilities by using interoperability standards. CIS systems in financial institutions in the region were used to enhance personalization and match the priorities of the Consumer Financial Protection Bureau (CFPB) of implementing straightforward communications with consumers and online interaction. Furthermore, stringent regulations regarding energy efficiency encourage utilities to invest in CISs.

Asia Pacific Customer Information System (CIS) Market Trends

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, owing to the rapid urbanization, expansion of digital infrastructure, and more investments in utility modernization. South Korea, India, Japan, and China are focusing on implementing smart metering and electronic billing platforms to facilitate the efficient distribution of energy. In 2024, the Indian Ministry of Power was in the second phase of its Smart Meter National Program, aiming to deploy more than 250 million smart meters and renew the demand for scalable, integrated CIS platforms.

China Customer Information System (CIS) Market Trends

The State Grid Corporation of China increased the use of customer information system (CIS) to handle customer information in larger volumes and comply with national carbon neutrality goals. Asia Pacific Energy Research Centre (APERC) included digital platforms to conduct customer-centric operations focused on the data-oriented service model. In 2024, The Ministry of Economy, Trade and Industry (METI) in Japan mandated customer information management in electricity retailing. Additionally, the government-led programs and the growing trends toward digital literacy and grid modernization further boost the market growth in this region.

European Customer Information System (CIS) Market Trends

Europe is expected to grow at a notable rate in the upcoming period. The market growth in the region can be attributed to stringent data protection laws, decarbonization strategies, and increasing focus on smart changeover of utilities. The Clean Energy for All Europeans package introduced by the European Union encouraged member-states to use innovative customer-focused digital infrastructure to provide transparent billing and energy efficiency plans. European countries such as Germany, France, and the Netherlands continued rollouts of smart meters and digital utility portals with an increased focus on real-time communications between providers and consumers, supporting regional market growth.

Germany Customer Information System (CIS) Trends

Germany’s focused on digital transformation, integrating cloud-based platforms, AI, and smart grid technology. The market is primarily driven by the energy sector’s modernization needs and the demand for customer-centric omnichannel experiences. Strict compliance with GDPR remains a fundamental requirement across all implementations.

Customer Information System (CIS) Market Value Chain Analysis

- Product Development & Innovation

This stage involves the research, design, and continuous improvement of CIS software and technology.

Key Players: SAP SE, Oracle Corporation, Kraken Technologies. - Operations & Implementation

This stage focuses on the delivery and deployment of CIS solutions to clients. It involves customizing software for specific business needs, migrating data from legacy systems, and ensuring seamless integration with existing IT infrastructure.

Key Players: IBM Corporation, Wipro Limited, and Hansen Technologies. - Marketing & Sales

This stage involves promoting and selling CIS solutions to target customers, such as utility companies, telecom providers, and other businesses with high customer volumes.

Key Players: Oracle Corporation, SAP SE, and MarketsandMarkets. - Post-Sales Services & Support

This final stage ensures customer satisfaction and loyalty through ongoing support, maintenance, and consulting.

Key Players: Fluentgrid Limited, Gentrack, and IBM Corporation.

Top Companies in the Customer Information System (CIS) Market & Their Offerings:

- Accenture: Accenture provides extensive consulting and system integration services for implementing advanced CIS solutions, helping businesses transform their customer operations and enhance digital experiences.

- Capgemini: Capgemini offers end-to-end services in the CIS market, from strategy and implementation to application management and support. Their focus lies in leveraging cloud and data analytics to modernize customer information systems and facilitate a seamless energy transition for utility clients.

- Cognizant: Cognizant helps clients modernize their legacy CIS platforms by leveraging digital technologies like AI, IoT, and cloud computing.

- DXC Technology: DXC Technology delivers comprehensive IT services for the CIS market, including modernization of core systems, cloud migration, and data analytics.

- HCL Technologies: HCL provides specialized engineering and R&D services in the CIS domain, focusing on developing next-generation, AI-driven platforms. They assist global companies in enhancing customer experiences and operational efficiency by integrating advanced technology into their information systems.

- IBM: IBM contributes significantly to the CIS market through its consulting expertise, cloud platforms, and data management solutions. They help businesses integrate complex customer information systems and harness data insights to provide personalized services and improve billing processes.

- Infosys: Infosys offers a range of services for the CIS market, from digital transformation consulting to system integration and managed services. They leverage automation and analytics to optimize utility operations and provide engaging, self-service customer experiences.

- NTT DATA Corporation: NTT DATA provides IT consulting, system development, and implementation services for the CIS market, with a strong presence in global utility sectors. They focus on delivering resilient and scalable solutions that help companies manage customer data effectively and adapt to evolving regulatory landscapes.

- Tata Consultancy Services (TCS): TCS offers a comprehensive portfolio of services for the CIS market, including platform modernization, data management, and digital transformation. They help utility and service providers improve customer retention and operational efficiency through integrated, AI-powered information systems.

- Wipro: Wipro assists clients in the CIS market with strategy formulation, implementation, and ongoing support for utility billing and customer care solutions.

Customer Information System (CIS) Market Companies

- Accenture

- Capgemini

- Cognizant

- DXC Technology

- HCL Technologies

- IBM

- Infosys

- NTT DATA Corporation

- Tata Consultancy Services

- Wipro

- In April 2025, Tredence, a global leader in data science and AI solutions, unveiled Customer 360 at Google Cloud Next 2025 in Las Vegas and Bengaluru. Purpose-built for enterprises in the telecom, media, and technology (TMT) sectors, the solution leverages Google Cloud Platform to unify fragmented customer data across touchpoints. Customer 360 offers real-time insights, hyper-personalization, and predictive analytics using over 2,500 behavioral signals. The platform’s Customer Engagement Driver, powered by generative AI, delivers instant, actionable intelligence through natural language processing, enabling business leaders and data scientists to bypass traditional dashboards and engage directly with customer data. With seamless integration across marketing, digital platforms, and contact centers, the system is designed to enhance customer retention, engagement, and revenue outcomes at scale.

- In May 2024, Newgen Software Inc. introduced LumYn, a generative AI-based decision intelligence platform developed to support banking institutions in optimizing profitability and improving customer engagement. LumYn enables users to pose complex business questions, such as how to expand card services, and generates responses by analyzing customer data conversationally. Designed for decision-makers in financial services, the platform enhances strategic planning while complying with strict data privacy regulations. Newgen confirmed that while LumYn powers the analysis, the underlying customer data remains hosted by the banks, in accordance with regulatory obligations around data localization and security.

- In February 2025, Freshworks Inc. announced a major strategic partnership with Unisys, a global technology solutions provider, to expand access to Freshworks’ modern IT Service Management (ITSM) offerings. Through this collaboration, Unisys will resell platforms like Freshservice and Device42, addressing a critical service gap in the underserved mid-market segment. As the first large-scale Managed Service Provider (MSP) within the Freshworks ecosystem, Unisys extends the reach of AI-driven service software to commercial, public sector, and financial service clients across over 120 countries. The alliance aims to improve IT operations, enhance customer support experiences, and streamline enterprise service delivery.

(Source: https://www.prnewswire.com)

(Source: https://www.ndtvprofit.com)

(Source:

Segments Covered in the Report

By Component

By Application

- Electricity and Power Management

- Utility Gas Management

- Water and Wastewater Management

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

link