Middle East Healthcare Information Systems Market, 2033

Market Size & Trends

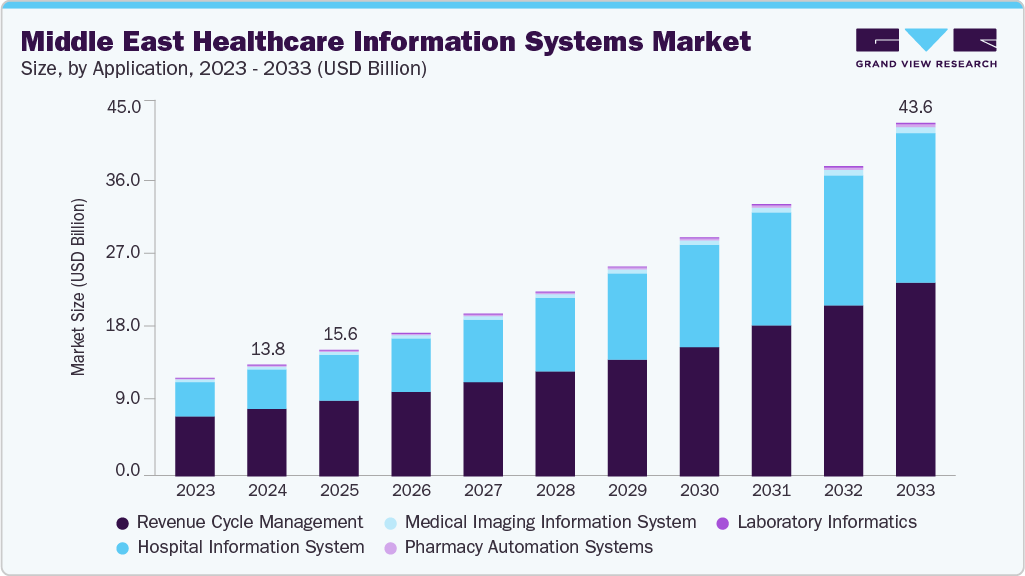

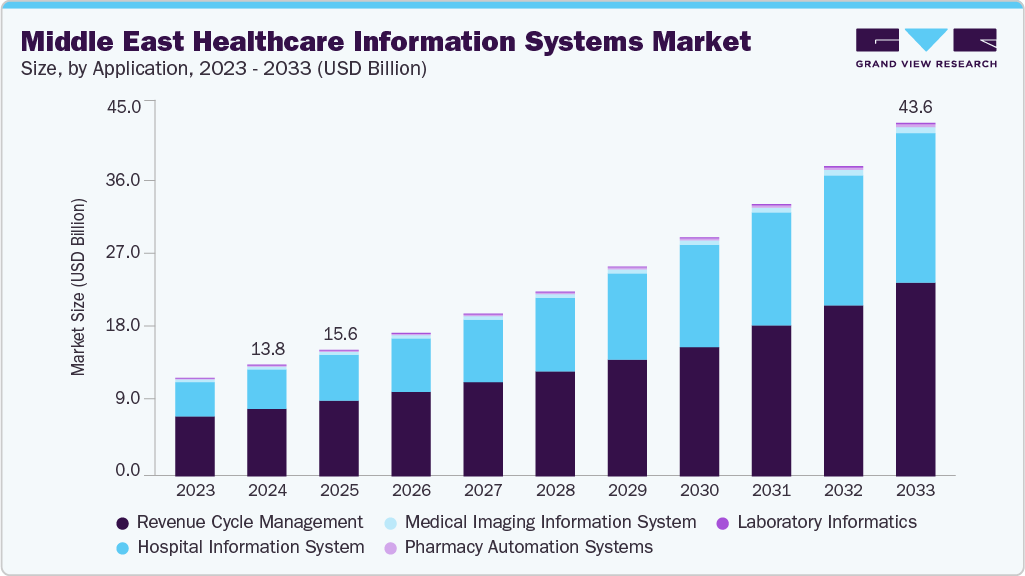

The Middle East healthcare information systems market size was estimation at USD 13.77 billion in 2024 and is projected to reach USD 43.65 billion by 2033, growing at a CAGR of 13.72% from 2025 to 2033. Rising prevalence of chronic diseases such as cancer and cardiovascular diseases, increasing number of surgeries, and growth in emergency and trauma care infrastructure are significant factors contributing to market growth.

The Middle East healthcare information systems industry is driven by the rapid digitization of healthcare services across the region. Governments and healthcare providers are increasingly adopting electronic health records (EHRs), hospital information systems (HIS), and telemedicine platforms to streamline patient care and administrative processes. This digital transformation is supported by substantial investments in health IT infrastructure, enabling interoperability and real-time data sharing among healthcare facilities. The growing smartphone penetration and internet accessibility further catalyzes the adoption of mobile health (mHealth) applications, enhancing patient engagement and remote care capabilities. These trends collectively promote efficient clinical, financial, and operational data management, driving market growth.

Rapid advancements in digital technologies, such as AI, cloud computing, and telehealth, are transforming the healthcare information systems market in the Middle East. These innovations align with national agendas, creating a digitally enabled healthcare ecosystem. The integration of these technologies within healthcare information systems (HIS) platforms is speeding up adoption and changing traditional care models. Furthermore, significant investments and collaborations among governments, healthcare providers, and technology companies are driving market expansion. For instance, in April 2025, Burjeel Holdings, a UAE-based healthcare services provider, partnered with Hippocratic AI, a generative AI company specializing in safety-focused large language models for healthcare, to expand AI-driven patient engagement across the Middle East.

Moreover, government initiatives and modernization programs are key market drivers in the Middle East healthcare information systems industry. National strategies such as Saudi Arabia’s Vision 2030 and the UAE’s National Unified Medical Record program exemplify efforts to create integrated, unified healthcare data ecosystems. These programs enhance healthcare delivery quality, regulatory compliance, and operational transparency. For instance, in April 2024, India-based medical voice AI innovator Augnito partnered with Cloud Solutions, a leading digital transformation company in the Middle East, to enhance healthcare efficiency through AI-powered clinical voice technologies. This partnership aims to improve accuracy, streamline workflows, and optimize resources, supporting Saudi Arabia’s Vision 2030 for an interoperable regional electronic health record (EHR) system.

Implementing digital licensing platforms and telehealth regulations incentivize healthcare providers to adopt advanced IT solutions for better patient outcomes and streamlined workflows. For instance, Saudi Arabia’s Seha Virtual Hospital (SVH) is the world’s largest virtual hospital, leveraging AI, augmented reality, digital twins, and remote diagnostics to revolutionize healthcare. In October 2024, the Saudi Ministry of Health launched the world’s largest digital health twin, integrating AI models to predict health issues and personalize care. Such government-backed initiatives provide a robust foundation for sustained regional market expansion.

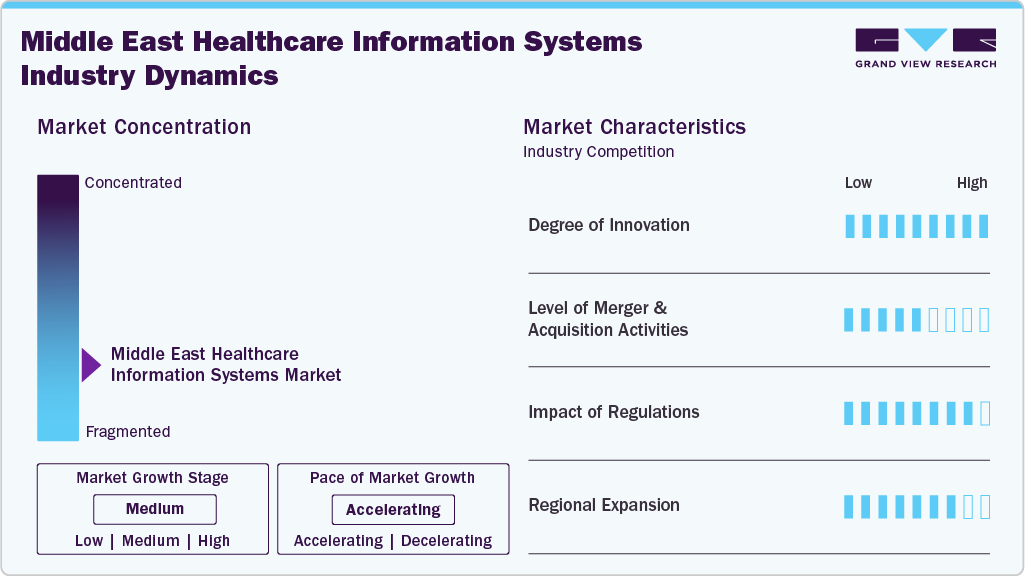

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The degree of innovation, the impact of regulations, and regional expansion of the industry is high. However, the level of merger & acquisition activities is moderate.

The Middle East healthcare information systems industry experiences a high degree of innovation. Increasing strategic initiatives by regional governments and key players fuel innovation in the market. For instance, in May 2024, Sheikh Shakhbout Medical City (SSMC) in Abu Dhabi inaugurated its Centre of Innovation and Medical Simulation, a state-of-the-art facility offering advanced training for healthcare professionals, including doctors, nurses, allied health workers, and students. The center features specialized simulation units for adults, pediatrics, pregnant women, and advanced endoscopy, ultrasound, burns, and trauma simulators.

The Middle East healthcare information systems industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market.

The regulatory framework of the Middle East healthcare information systems industry is driven by government-led initiatives that mandate digital transformation, data standardization, and compliance with international healthcare norms. Regulators emphasize cybersecurity and patient data privacy, aligning regional practices with global standards such as HIPAA and GDPR. The regulatory environment thus governs the deployment, use, and governance of healthcare information systems, fostering trust and compliance in digital health ecosystems.

The Middle East healthcare information systems industry is witnessing high geographical expansion. Companies within the Middle East healthcare information systems industry seek geographic expansion strategies to maintain their foothold in the markets and attract customers from this region. With the growing adoption of digital healthcare solutions, the market is expected to grow significantly in the coming years. For instance, in April 2025, Amazon Web Services (AWS) and Oracle announced major cloud and AI skills development initiatives in the Middle East.

Application Insights

The revenue cycle management segment led the market with the largest revenue share of 60.41% in 2024. Increasing adoption of health insurance, regulatory and compliance requirements, and expansion of healthcare infrastructure are factors contributing to the segment’s growth. Hospitals require platforms to manage billing, coding, claims, and payment processes efficiently across multiple service lines. With rapid infrastructure growth, providers seek scalable solutions to handle larger patient volumes. For instance, in April 2025, Claritev Corporation and Claims Care Revenue Cycle Management LLC partnered to enhance revenue cycle management (RCM) in the Middle East region. The collaboration combines Claritev’s advanced claims analytics and AI-driven solutions with Claims Care’s regional expertise.

The hospital information systems segment is anticipated to register at the fastest CAGR over the forecast period, due to rising demand for integrated platforms that streamline clinical, administrative, and financial workflows. Hospitals are adopting HIS to centralize patient records, optimize resource allocation, and improve communication across departments. These systems reduce redundancies and enhance operational efficiency, enabling providers to manage growing patient volumes more effectively.

Deployment Insights

The web-based segment led the market with the largest revenue share of 36.88% in 2024, due to its cost-effectiveness and minimal infrastructure requirements. Unlike on-premises systems, web-based platforms reduce upfront capital expenditure, making them attractive for mid-sized hospitals, clinics, and diagnostic centers. They can be accessed directly through internet browsers, enabling quick deployment and easier adoption across diverse care settings. This affordability and flexibility support widespread acceptance among healthcare providers.

The cloud-based deployment segment is expected to grow at the fastest CAGR from 2025 to 2033, due to its scalability and ability to support large, multi-facility healthcare networks. Cloud platforms enable centralized data storage, seamless integration of clinical and administrative systems, and remote accessibility across locations. They reduce dependency on heavy IT infrastructure, lowering operational costs while ensuring system reliability. Advanced features such as AI-driven analytics, automated updates, and real-time monitoring further enhance their value. These capabilities are driving healthcare providers to shift from traditional systems to cloud-based solutions.

Component Insights

Based on component, the services segment led the market with the largest revenue share of 61.48% in 2024, due to the increasing need for implementation, customization, and ongoing technical support. Many healthcare providers in the region face challenges in deploying complex IT systems, making professional services critical for successful adoption.

Service providers assist with the integration of electronic health records, hospital information systems, and billing platforms, ensuring smooth interoperability. Continuous upgrades and maintenance are also vital as regulatory frameworks evolve. This reliance on specialized expertise is driving strong demand for healthcare IT services.

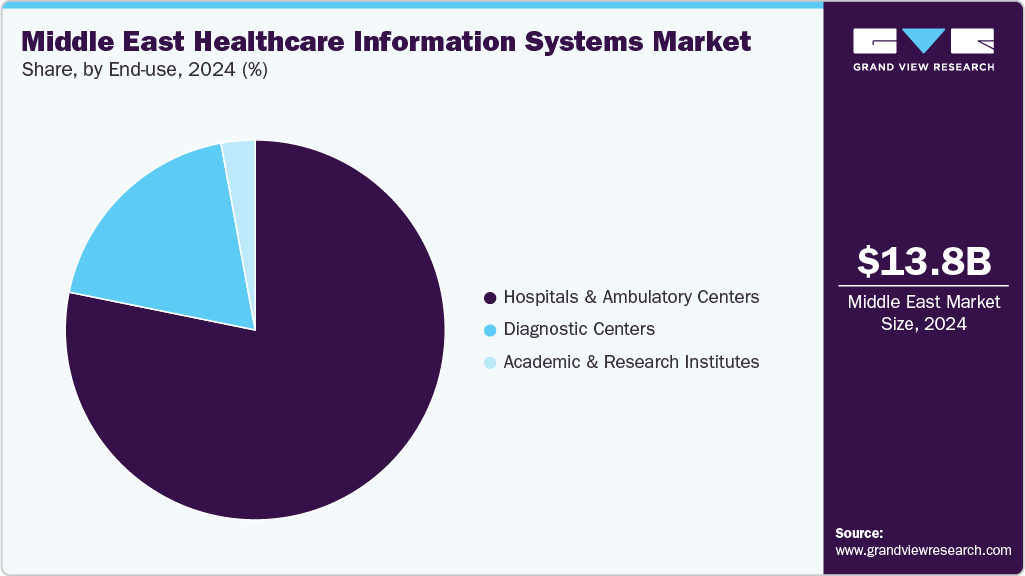

End-use Insights

The hospitals and ambulatory services segment led the market with the largest revenue share of 74.19% in 2024, due to the rising demand for efficient management of large patient volumes. Hospitals are adopting advanced information systems to centralize patient data, streamline workflows, and enhance coordination across departments. Government-backed digital health initiatives are accelerating the shift toward electronic records and interoperable systems. These solutions enable hospitals to improve clinical decision-making and optimize resource utilization. For instance, in May 2025, Al Zahra Hospital Dubai partnered with InterSystems to implement the TrakCare unified health information system (HIS) as its electronic medical record (EMR) platform. The 10-year agreement includes modules for Revenue Cycle Management (RCM), clinical functions like OT and anesthesia, critical care units, pharmacy, oncology, maternity, radiology, laboratories, and patient administrative services.

The diagnostic centers segment is anticipated to grow at the fastest CAGR from 2025 to 2033, owing to the increasing demand for advanced imaging, pathology, and molecular testing services. Growing prevalence of chronic diseases and emphasis on early detection are driving higher patient volumes in diagnostic facilities. Healthcare information systems enable these centers to integrate test results with electronic health records, improving accuracy and turnaround times. The ability to support seamless data sharing with hospitals and physicians enhances coordinated care. This growing reliance on digital platforms positions diagnostic centers for rapid market expansion.

Country Insights

Saudi Arabia dominated the Middle East healthcare information systems market with the largest revenue share of 31.20% in 2024. This is primarily driven by government reforms under Vision 2030, emphasizing healthcare modernization and digital transformation. The Ministry of Health is investing in electronic health records, hospital information systems, and integrated platforms to improve accessibility and efficiency of care delivery. For instance, in January 2025, Sanabil Investments, owned by Saudi Arabia’s Public Investment Fund (PIF), partnered with Redesign Health to accelerate healthcare innovation in Saudi Arabia.

“Saudi Arabia’s rapidly evolving healthcare and business landscape presents an extraordinary opportunity to build world-class healthcare companies. We look forward to working with Sanabil and dynamic Saudi healthcare partners to empower founders to transform healthcare in the service of patients.”

– Adam Jones, Redesign Health Managing Director.

Moreover, hospitals and clinics are adopting digital platforms to streamline workflows, optimize resource use, and improve care coordination across multiple facilities. Advanced technologies such as AI, cloud computing, and interoperability tools are being integrated to enhance efficiency and decision-making.

UAE Healthcare Information Systems Market Trends

The healthcare information systems market in the UAE is driven by strong government-led initiatives aimed at advancing digital health under its national vision. The country is pioneering a digital health revolution emphasizing interoperability, artificial intelligence integration, and patient-centered care. Regulatory frameworks and investments in e-health infrastructure are accelerating the adoption of electronic health records and hospital information systems.

The UAE market is also fueled by active collaboration between private healthcare providers, insurers, and technology startups to drive innovation. Partnerships, such as Cigna Healthcare’s entry into the UAE’s startup ecosystem in July 2025 and TruDoc’s collaboration with E-Enterprise in July 2024, highlight the growing demand for digital platforms that enhance communication, telehealth, and care delivery.

Key Middle East Healthcare Information Systems Company Insights

Key players operating in the Middle East healthcare information systems industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth. The UAE is pioneering a digital health revolution that emphasizes interoperability, artificial intelligence integration, and patient-centered care. Regulatory frameworks and investments in e-health infrastructure are accelerating the adoption of electronic health records and hospital information systems.

Key Middle East Healthcare Information Systems Companies:

- ResMed

- Koninklijke Philips N.V.

- IBM

- Oracle IQVIA

- TruBridge (CPSI)

- AdvancedMD, Inc.

- Oracle

- Optum

- GE Healthcare

- Veradigm LLC

- Epic Systems Corporation

- ACCUMED

- Assurance Revenue Cycle Management

- HealthSoft

Recent Developments

-

In February 2025, Burjeel Holdings launched one of the Middle East region’s largest Electronic Medical Record (EMR) platforms, powered by Oracle Health, to transform patient care, improve clinical outcomes, and enhance operational efficiencies. The platform is hosted on Oracle Cloud Infrastructure in the Dubai Region and integrates AI-driven decision support, real-time patient insights, and streamlined workflows. It enables comprehensive access to patient data, enhances safety with alerts, and provides actionable data analytics.

-

In October 2024, Oracle unveiled its next-generation Electronic Health Record (EHR) system. The EHR integrates AI across clinical workflows, automating processes, providing real-time insights, simplifying appointment preparation, documentation, and follow-ups. It supports seamless information exchange between payers and providers, facilitates clinical trial recruitment, optimizes financials, and accelerates value-based care adoption.

-

In March 2021, Kuwait’s Health Assurance Hospitals Company (DHAMAN) selected InterSystems to implement its new Electronic Medical Record (EMR) system, TrakCare, as part of a comprehensive digital healthcare strategy.

Middle East Healthcare Information Systems Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 15.60 billion

|

|

Revenue forecast in 2033

|

USD 43.65 billion

|

|

Growth rate

|

CAGR of 13.72% from 2025 to 2033

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2021 – 2023

|

|

Forecast period

|

2025 – 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, deployment, component, end-use, country

|

|

Regional scope

|

Middle East

|

|

Country scope

|

Saudi Arabia; UAE; Qatar; Oman; Kuwait

|

|

Key companies profiled

|

ResMed; Koninklijke Philips N.V.; IBM; Oracle IQVIA; TruBridge (CPSI); AdvancedMD, Inc.; Oracle; Optum; GE Healthcare; Veradigm LLC; Epic Systems Corporation; ACCUMED; Assurance Revenue Cycle Management; HealthSoft

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Middle East Healthcare Information Systems Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East healthcare information systems market report based on application, deployment, component, end-use, and country.

-

Application Outlook (Revenue, USD Million, 2021 – 2033)

-

Hospital Information System

-

Electronic Health Record

-

Electronic Medical Record

-

Real-time Healthcare

-

Patient Engagement Solution

-

Population Health Management

-

-

Pharmacy Automation Systems

-

Medication Dispensing System

-

Packaging & Labeling System

-

Storage & Retrieval System

-

Automated Medication Compounding System

-

Tabletop Tablet Counters

-

-

Laboratory Informatics

-

Revenue Cycle Management

-

Medical Imaging Information System

-

Radiology Information Systems

-

Monitoring Analysis Software

-

Picture Archiving and Communication Systems

-

-

-

Deployment Outlook (Revenue, USD Million, 2021 – 2033)

-

Web-based

-

On-premises

-

Cloud-based

-

-

Component Outlook (Revenue, USD Million, 2021 – 2033)

-

Hardware

-

Software & Systems

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2021 – 2033)

-

Country Outlook (Revenue, USD Million, 2021 – 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East healthcare information system market size was estimated at USD 13.77 billion in 2024 and is expected to reach USD 15.61 billion in 2025.

b. The Middle East healthcare information system market is expected to grow at a compound annual growth rate of 13.72% from 2025 to 2033 to reach USD 43.65 billion by 2033.

b. The revenue cycle management segment held the largest market share of 60.41% in 2024.

b. Some key players operating in the Middle East healthcare information system market include ResMed; Koninklijke Philips N.V.; IBM; Oracle IQVIA; TruBridge (CPSI); AdvancedMD, Inc.; Oracle; Optum; GE Healthcare; Veradigm LLC; Epic Systems Corporation; ACCUMED; Assurance Revenue Cycle Management; HealthSoft.

b. Key factors that are driving the Middle East healthcare information system market are rising prevalence of chronic diseases such as cancer and cardiovascular diseases, increasing number of surgeries, and growth in emergency and trauma care infrastructure.

link